Emory University may face a potential endowment income tax increase of $26 million in 2026 after President Donald Trump’s “One Big Beautiful Bill Act” established a new tiered endowment tax rate. This figure is almost three times the $9 million endowment tax paid in 2024. Emory currently has an endowment of nearly $11.4 billion. According to an Emory News Center article regarding the endowment tax’s impact on the University’s mission, Emory is anticipated to fall under the 4% tax category, and the change will take effect in 2026.

The 4% tax rate requires Emory to pay an estimated $26 million based on its endowment income. The 2017 Tax Cuts and Jobs Act originally created a flat tax of 1.4% on private colleges and universities’ endowments. However, the U.S. House of Representatives passed the “One Big Beautiful Bill Act” on July 3, adding a 4% and 8% bracket for larger endowments.

The federal government aims to hold “woke, elite universities that operate more like major corporations and other tax-exempt entities accountable” with this tax, according to the House Committee on Ways & Means. Through the legislation, the committee expanded on existing endowment tax policy for higher education institutions.

Many U.S. colleges and universities are now facing fiscal challenges due to the increased endowment tax, including cuts to financial aid and increases in tuition.

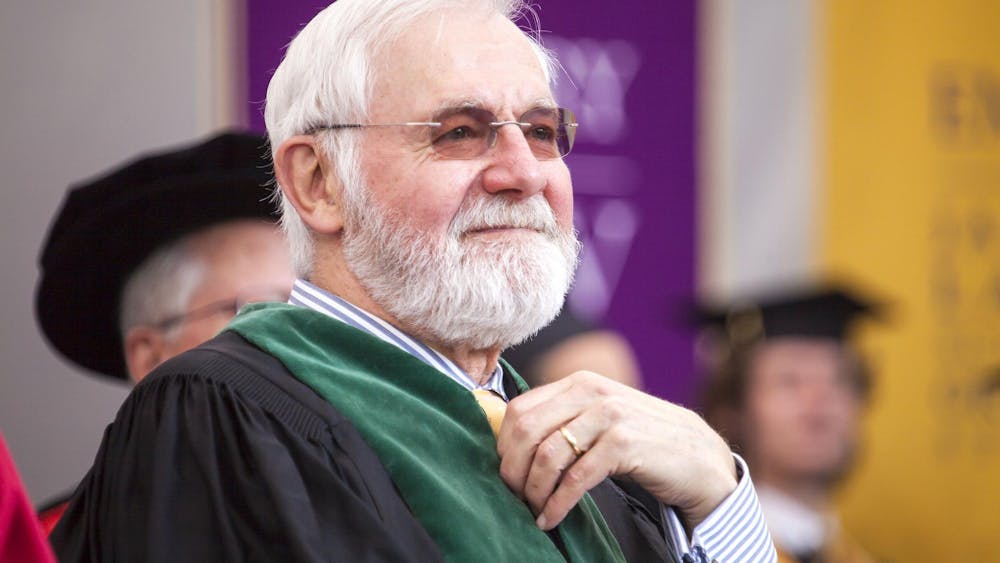

Arts and Sciences Distinguished Professor of Economics Esfandiar Maasoumi clarified that the tax is not on the endowment itself but the income it generates. He called the tax “anti-education” and “regressive,” as it undermines students’ research opportunities and available scholarships. Maasoumi said Emory’s administration is facing uncertainty in financial planning for the tax.

“They’re in a bit of a panic,” Maasoumi said. “They’ve frozen hiring, salaries, lots of measures that anticipate that it might qualify for taxes.”

Associate Professor of Data & Decision Sciences and Political Science Pablo Montagnes said the endowment tax penalizes “the concentration of wealth,” especially in elite, wealthy universities. On the other hand, small liberal arts colleges such as Amherst College (Mass.) and Swarthmore College (Pa.) are exempt from the new tax. Montagnes speculated that “political elements” also influenced the decisions.

“There were exceptions made, so for schools that were below a certain size, that was largely made to protect more conservative religious schools that have high endowment per capita, at least, that’s what the coverage suggests,” Montagnes said.

Maasoumi added that the tax will harm higher education in the U.S., raising concerns about international students opting to pursue their education elsewhere.

“The attitude by the policymakers right now is anti-elitism and education,” Maasoumi said. “Higher education is regarded as part of that cultural war going on.”

In an Emory News Center article, Advancement and Alumni Engagement Senior Vice President Josh Newton and Government and Community Affairs Vice President Cameron Taylor emphasized the importance of Emory’s endowment for scholarships, professorships, research and clinical care.

“Endowments are not idle reserves,” Newton and Taylor wrote. “They are purpose-driven investments in students, teachers, research teams, patients, health care providers and community members. When a nonprofit private university is taxed, the people who suffer are those we serve.”

Associate Professor of Economics Chris Karbownik added that Emory could increase enrollment, which could result in the University paying a lower rate of 1.4%. Additionally, he suggested that the University could stop selling assets to generate income or use assets that generated losses to reduce the amount of taxable income. In this case, Emory may still fall under the 4% category but pay less because the school’s total investment income is lower.

“It’s up to the administration to figure out where the money comes from, and given Emory’s legacy, I would be shocked if they compromise on teaching,” Karbownik said. “I don’t think that’s where the cuts are going to be.”

Economics Assistant Teaching Professor and Director of Professionalism and Placement Keith Robinson expressed hope that Emory would not compromise its current approach to financial aid and student scholarships despite the tax.

“I would like to think that the University is looking to provide financial aid from endowments, and I think they want to continue to do that, because that makes the University competitive, and it’s part of its mission and overall education,” Robinson said.

However, Robinson mentioned that grant cuts, along with the tax, would hurt research, especially healthcare-related research. Emory reports that around 40% of the endowment funds “health care” and “health sciences.”

“The bigger hit to research, without a doubt, is grant cuts,” Robinson said. “A sizable chunk of the endowment at Emory is healthcare related.”

While $26 million in endowment taxes will certainly affect the University, Emory is not among the schools hit the hardest by the tax hike. Harvard University (Mass.) could pay more than $200 million annually in endowment taxes and Stanford University (Calif.) could pay an estimated $202 million from an 8% tax on endowment income based on its current endowment of $37.6 billion.

Lauren Yee (she/her) (24Ox, 27C) is a managing editor at The Emory Wheel. She is from Hong Kong, majoring in religion and German. Outside of the Wheel, Yee is the president of the Hong Kong Student Association and the managing editor for In Via, Emory's Christian thought journal. In her free time, you can find her playing the saxophone, watching musicals, listening to Taylor Swift or enjoying a pumpkin cream chai!